r&d tax credit calculation uk

Ad ForrestBrown is the UKs leading specialist RD tax credit consultancy. If you spend money creating or improving products or services.

Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors.

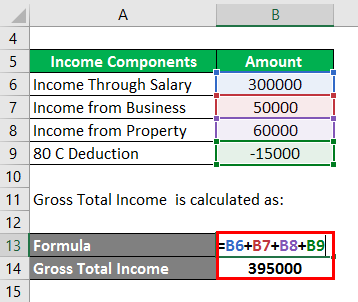

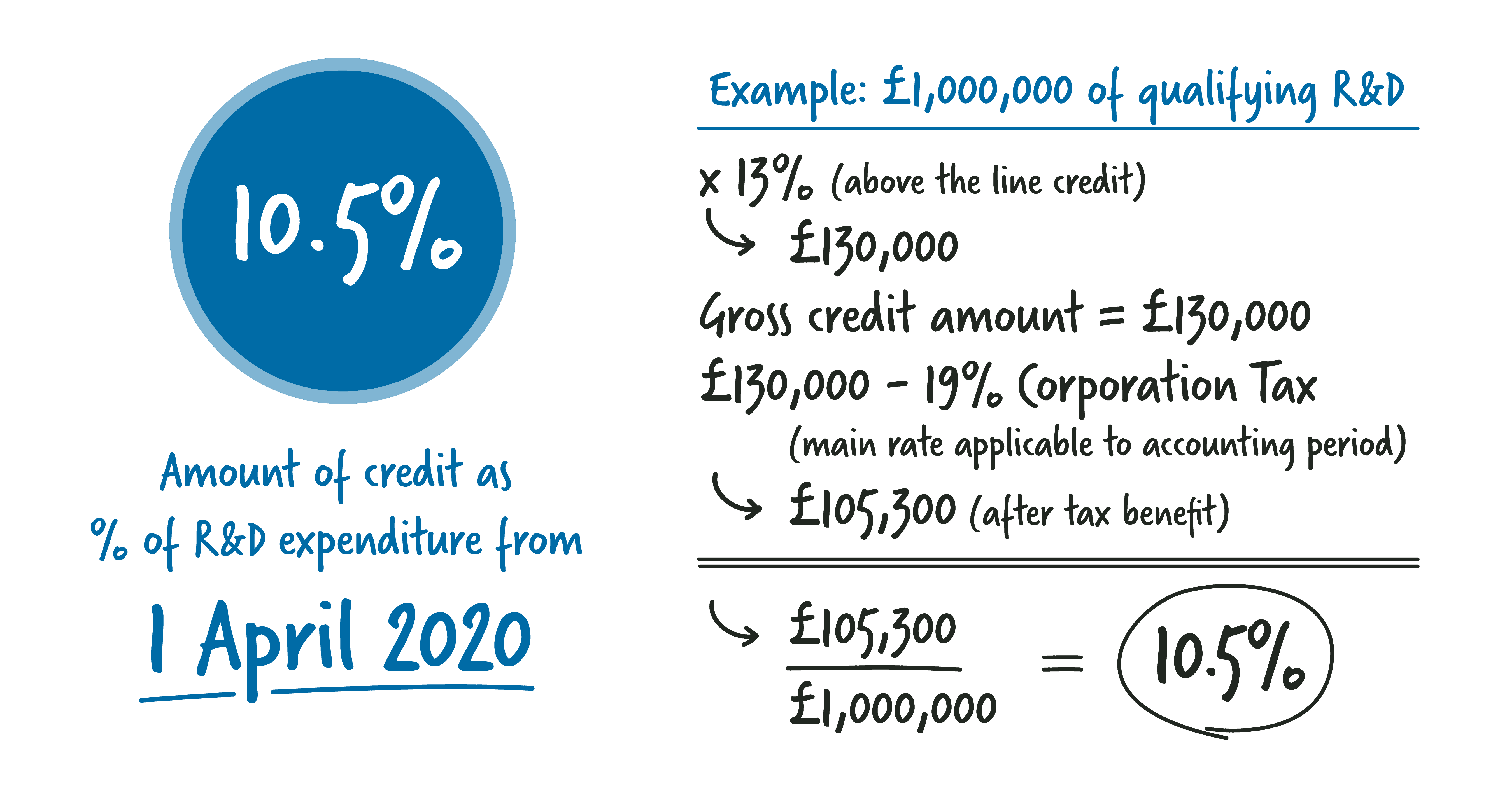

. Introduced in 1981 by the federal government the RD or Research and Development Tax Credit is a credit on your income tax return. Average calculated RD claim is 56000. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable.

Company X made profits of 400000 for the year calculate the RD tax credit saving. 10000 x 130 enhancement rate 13000. Connect to XERO and get a personalised RD Tax claim estimate in 2 minutes.

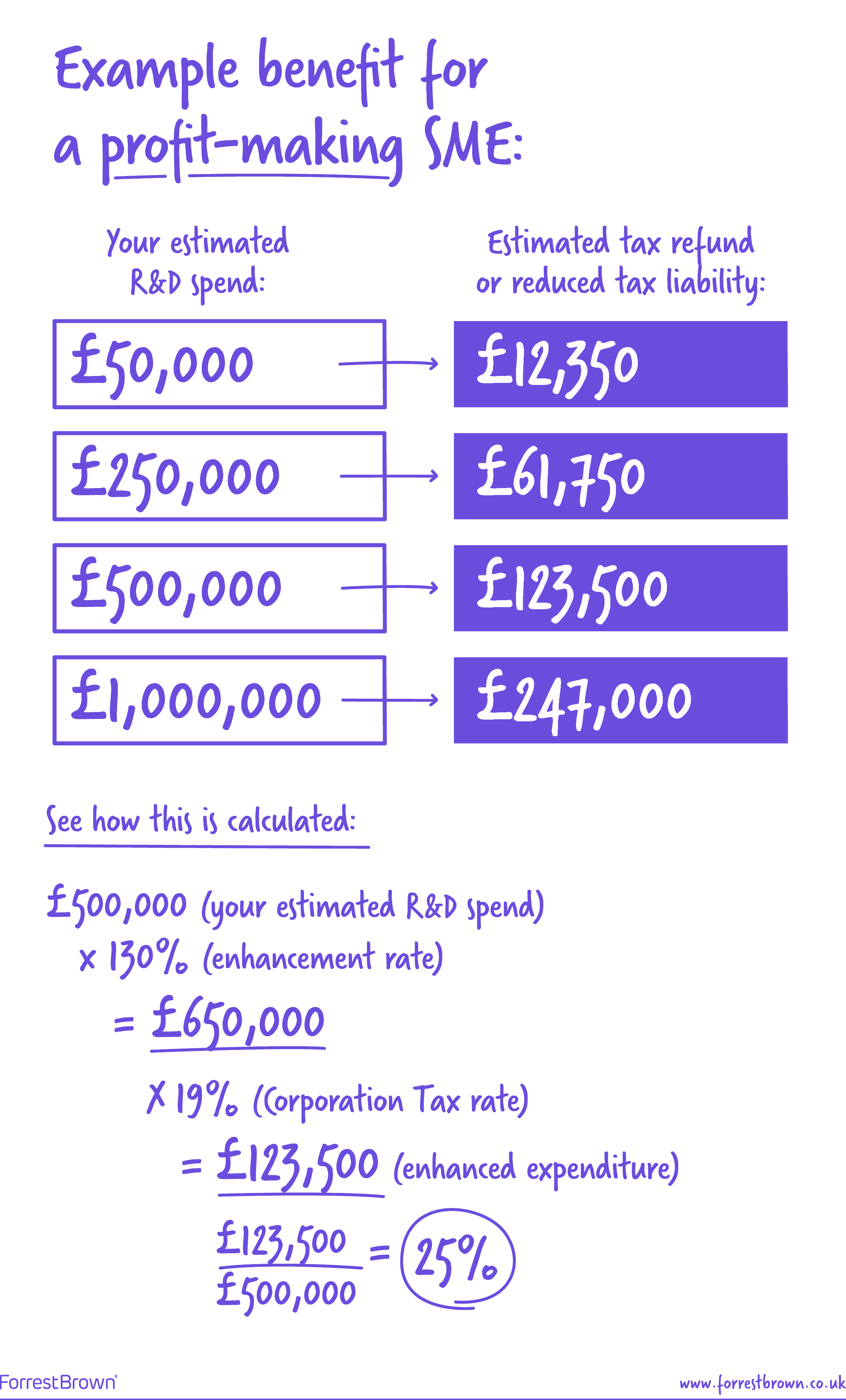

The RDEC is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. Sample calculations for RD tax relief claims. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they.

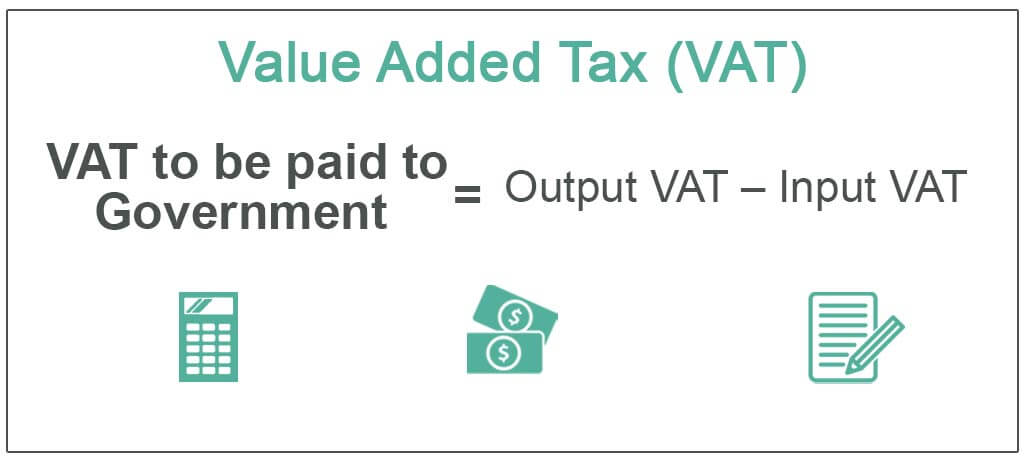

RD Tax Credit Calculator. 12 from 1 January 2018 to 31 March 2020. As the name suggests the RD.

29625 from corporation tax savings and the payable tax credit. The rate of relief is 25. Discover the UKs 1st RD Tax Credit Claim Estimator 90 Accurate Real-time.

Show how this example is calculated. Calculate how much RD tax relief your business could claim back. The qualifying expenditure is 100000 thats already in accounts as expenditure.

Get to know how much RD spend your company can claim back. If youre a loss-making business youll receive your RD tax credit in. This calculation example shows how RD tax credits can benefit a.

We estimate you could receive up to. Ad ForrestBrown is the UKs leading specialist RD tax credit consultancy. This can be done for the current financial year and the 2 previous.

Rd tax credit calculation uk. If the company spent 100000 on RD. In total they would receive back 1975 of their RD.

Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. RD Tax Credits Calculator. Complete the form below to find out how.

Free RD Tax Calculator. One of the hard issues to understand about RD Tax. The calculation shows how this affects a profitable company.

2103 FI Group UK- New. 2403 UK 2022-2025 RD Budget. The rise in the rate of relief for smes means that the cash value of claims for tax paying companies is 26 for every 100 of rd spend from april.

According to the latest available figures UK companies claimed a total of 74. RD Tax Credits are a very niche part of the UK tax code that could bring your company thousands of pounds in tax relief. It was increased to.

13000 x 19 corporation tax rate 2470. RD Tax Credit is 212500 1453081250 CT600 boxes 530875 Losses to carry forward are zero. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC.

Enhanced RD qualifying spent would be now 325000 x 130 which makes the revised loss of 275000. As a tax benefit. Profit-making SME with 10000 RD spend.

The average value of a claim in the SME and RDEC schemes is 53876 and 272881 respectively. Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. Contact us to find out how much RD tax benefits could be worth to your business.

Universal Credit to council tax rebate - how to check if youre missing out on hundreds 13 MILLION people across the UK are set to be pushed into poverty due to the cost. So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. On this page you can calculate the value of your Research Development tax credits claim.

2403 Metaverse and Web 30.

Taxable Income Formula Calculator Examples With Excel Template

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Adp

Value Added Tax Definition Formula Vat Calculation With Examples

R D Tax Credit Calculation Examples Mpa

Taxable Income Formula Examples How To Calculate Taxable Income

Payroll Tax Q Series Robust Tax Engine Vertex Inc

R D Tax Credit Rates For Sme Scheme Forrestbrown

Invoice Or Bill Discounting Or Purchasing Bills Trade Finance Accounting And Finance Financial Strategies

Business Plan Examples Uk Business Plan Example Marketing Plan Template Marketing Plan Example

China Annual One Off Bonus What Is The Income Tax Policy Change

How Is R D Tax Relief Calculated Guides Gateley

R D Tax Credit Calculation Examples Mpa

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Calculation Examples Mpa

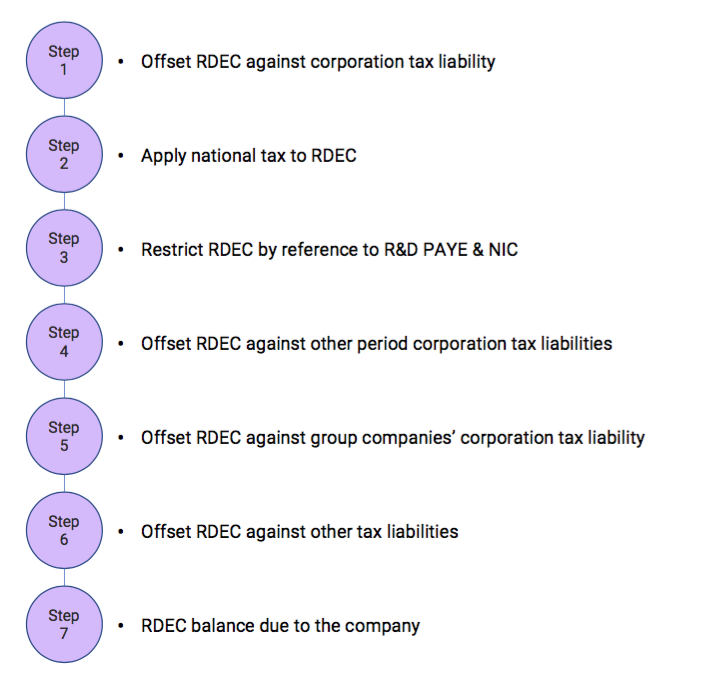

Rdec 7 Steps R D Tax Solutions

How Is Tax Liability Calculated Common Tax Questions Answered

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)